In Texas, title loans without income verification have gained popularity as a fast cash option, especially for those with unstable employment or limited credit history. Borrowers should carefully compare providers by examining interest rates, fees, repayment terms, and hidden penalties. Reputable companies like CreditBowl and LoanStar Title Loans offer these services using advanced technology for vehicle valuation. Houston Title Loans and Car Title Loans from LoanStar are known for fair assessments, swift funding, and customer-friendly approaches, providing Texans with accessible quick cash without income verification.

In the diverse financial landscape of Texas, understanding your options for title loans without income verification is crucial for those seeking quick cash solutions. This article delves into the intricacies of Texas title loans with no income check requirements, equipping you to navigate and compare providers effectively. We explore key factors and highlight top-rated companies offering these services today, ensuring an informed decision in the ever-evolving financial market.

- Understanding Texas Title Loans with No Income Verification Requirements

- Key Factors to Consider When Comparing No Income Verification Loan Providers in Texas

- Top-Rated Texas Title Loan Companies Offering No Income Check Services Today

Understanding Texas Title Loans with No Income Verification Requirements

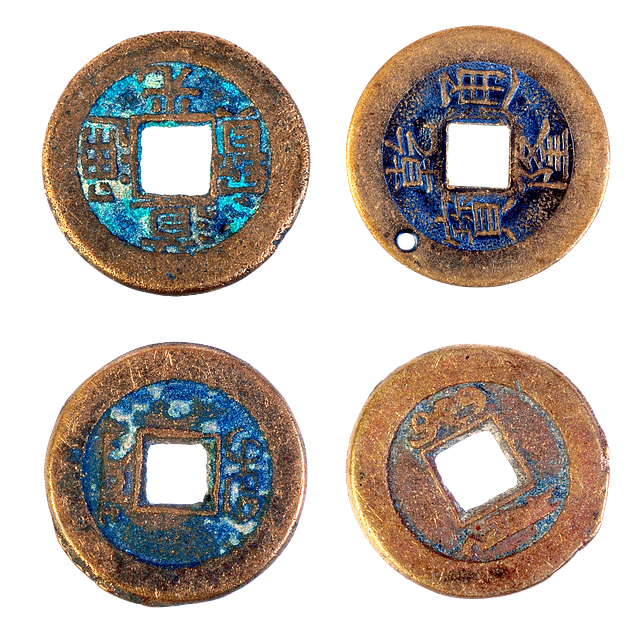

In Texas, title loans with no income verification have emerged as a financial option for individuals seeking quick cash. These loans are secured against a person’s vehicle ownership, allowing lenders to hold onto the vehicle’s title until the loan is repaid. This type of loan is particularly appealing for those who may not meet traditional borrowing criteria due to lacking consistent employment or insufficient credit history. By using their vehicle’s equity, borrowers can access funds without the stringent verification processes often required for other loan types.

Texas title loan no income verification providers cater to a diverse range of borrowers, including those interested in motorcycle title loans, car title loans, and similar secured lending options. The process involves assessing the value of the borrower’s vehicle, setting a loan amount based on that assessment, and then releasing the funds once the title is transferred and the agreement signed. This alternative financing method offers flexibility for individuals in need of immediate financial support, though it’s crucial to understand the terms and conditions before proceeding.

Key Factors to Consider When Comparing No Income Verification Loan Providers in Texas

When comparing Texas title loan no income verification providers, there are several key factors to keep in mind. Firstly, consider the interest rates and fees charged by each lender. Since these loans are typically short-term, high-interest rates can quickly accumulate, making them more expensive than traditional bank options. Look for transparent pricing structures that clearly outline the total cost of borrowing.

Secondly, evaluate the repayment terms and payment plans offered. Many no income verification loan providers in Texas provide flexible repayment options to suit different borrower needs. Consider the availability of extended payment plans, which can help manage cash flow during emergencies, or fast cash options for those who need immediate relief. Additionally, check if there are any hidden penalties or fees associated with early repayment or missed payments.

Top-Rated Texas Title Loan Companies Offering No Income Check Services Today

When it comes to top-rated Texas title loan companies offering no income verification services, several stand out for their reliability and customer-centric approach. Among them, CreditBowl and LoanStar Title Loans are leading the way in providing accessible and swift funding solutions without requiring extensive financial documentation. These providers understand that not everyone can provide traditional proof of income, making their no income check services a game-changer for many Texans in need of quick cash.

Houston Title Loans, for instance, leverages advanced vehicle valuation technology to ensure fair and accurate assessments, providing peace of mind for borrowers. Similarly, Car Title Loans from LoanStar offers a streamlined process, allowing you to borrow against the value of your vehicle without needing to verify your income. These companies prioritize customer satisfaction, making them popular choices among those seeking Texas title loan no income verification services.

When exploring Texas title loan options with no income verification, it’s crucial to balance accessibility with responsible lending practices. By understanding the key factors and comparing top-rated providers, borrowers can make informed decisions that meet their financial needs without compromising long-term stability. Remember, while these loans can offer quick access to cash, they come with risks, so choosing a reputable company and adhering to prudent borrowing habits is essential.