Texas title loans without income verification provide rapid cash access using vehicle equity, aiding those with irregular incomes or poor credit history. However, they carry significant risks: strict inspections, high-interest rates, short repayment periods, and potential vehicle repossession. These loans can trap borrowers in debt cycles; alternatives like extended loan terms or secured loans offer better management of debt and credit building over time.

In the competitive financial landscape of Texas, understanding the implications of a title loan with no income verification is crucial. This article delves into the intricate details of these loans and their effect on your credit score. We explore how these short-term lending practices work, particularly in Texas, and analyze their potential impact on your financial health. Additionally, we offer alternative strategies to navigate financial challenges without compromising long-term creditworthiness.

- Understanding Texas Title Loans and No Income Verification Requirements

- The Impact on Credit Scoring: How These Loans Can Affect Your Score

- Alternative Options and Strategies to Consider for Better Financial Health

Understanding Texas Title Loans and No Income Verification Requirements

Texas title loans have gained popularity as a quick solution for individuals seeking financial assistance. These loans are secured by a person’s vehicle, allowing lenders to offer funding despite traditional credit checks. The no income verification requirement is a unique aspect of Texas title loans, making them accessible to a broader range of borrowers. This feature means that individuals with irregular income streams or those lacking direct deposit records can still apply for a loan.

When considering a Texas title loan no income verification, potential borrowers should understand the process involves a thorough vehicle inspection. Lenders assess the condition and value of the collateral (usually a car or truck) to determine loan eligibility. Unlike traditional loans, where credit scores play a significant role, these titles focus on the equity in the vehicle. This alternative financing option can be beneficial for folks in need of fast cash, but it’s crucial to weigh the potential risks and interest rates associated with such arrangements.

The Impact on Credit Scoring: How These Loans Can Affect Your Score

Texas title loans that offer no income verification can significantly impact your credit score, often in ways that go beyond immediate loan repayment. When you apply for a loan with relaxed verification requirements, lenders typically assess your asset value and equity position in a vehicle, rather than traditional financial metrics like income and employment history. This alternative scoring method can be beneficial for those lacking consistent income or a strong credit history.

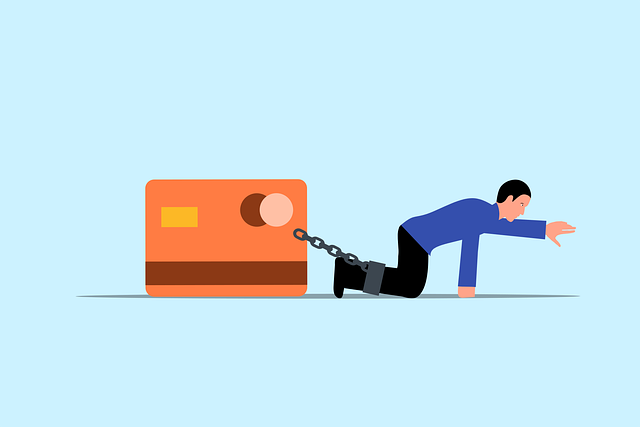

However, these loans carry a higher risk for lenders, which may translate to less favorable loan terms. Short repayment periods, high-interest rates, and fees could be typical features. Moreover, if you fall behind on payments, the lender may repossess your vehicle, impacting your ability to access transportation and potentially hindering future loan eligibility for traditional financial products. Therefore, while Texas title loans with no income verification can provide a quick solution for short-term cash needs, they should be considered carefully in light of their potential long-term effects on your credit score and overall financial health.

Alternative Options and Strategies to Consider for Better Financial Health

When considering a Texas title loan with no income verification, it’s crucial to understand that while it may offer quick access to cash, it could significantly impact your credit score and overall financial health. This type of loan, due to its high-interest rates and short repayment periods, can create a cycle of debt. An alternative strategy is to explore options that build rather than burden your creditworthiness.

One viable approach is to negotiate extended loan terms with traditional lenders or financial institutions. A loan extension allows for smaller, more manageable monthly payments, reducing the strain on your finances. Additionally, maintaining vehicle ownership and leveraging it as collateral for a secured loan can provide better interest rates and repayment conditions compared to title loans. These alternatives not only help manage debt but also contribute to building and improving your credit score over time.

Texas title loans with no income verification can provide a short-term financial solution, but they also come with risks. While these loans might offer quick access to cash, the potential impact on your credit score could be significant. High-interest rates and aggressive collection practices may contribute to poor credit health. To maintain or improve your credit standing, exploring alternative options like building an emergency fund, negotiating with creditors, or seeking financial counseling is advisable. By understanding these risks and considering healthier financial strategies, individuals can avoid the negative consequences of Texas title loans no income verification on their credit score.